Default by Design

Ranking Member Warren Breaks Down How Trump’s “Big, Beautiful Bill” is an Economic Wrecking Ball for Student Borrowers

Donald Trump and Congressional Republicans are turning their backs on families across the country. While Trump and friends are working overtime to pass gigantic tax giveaways to billionaires, millions of hard working people are barely hanging on financially.

American household debt has jumped by more than $4 trillion dollars from its pre-pandemic levels, now reaching a record-breaking $18.2 trillion. That means millions of families are borrowing to make it to the end of the month. For some, the debt loads have already toppled them. Credit card delinquencies and car repossessions are near the levels of the 2008 crash. The pain is widespread and getting worse.

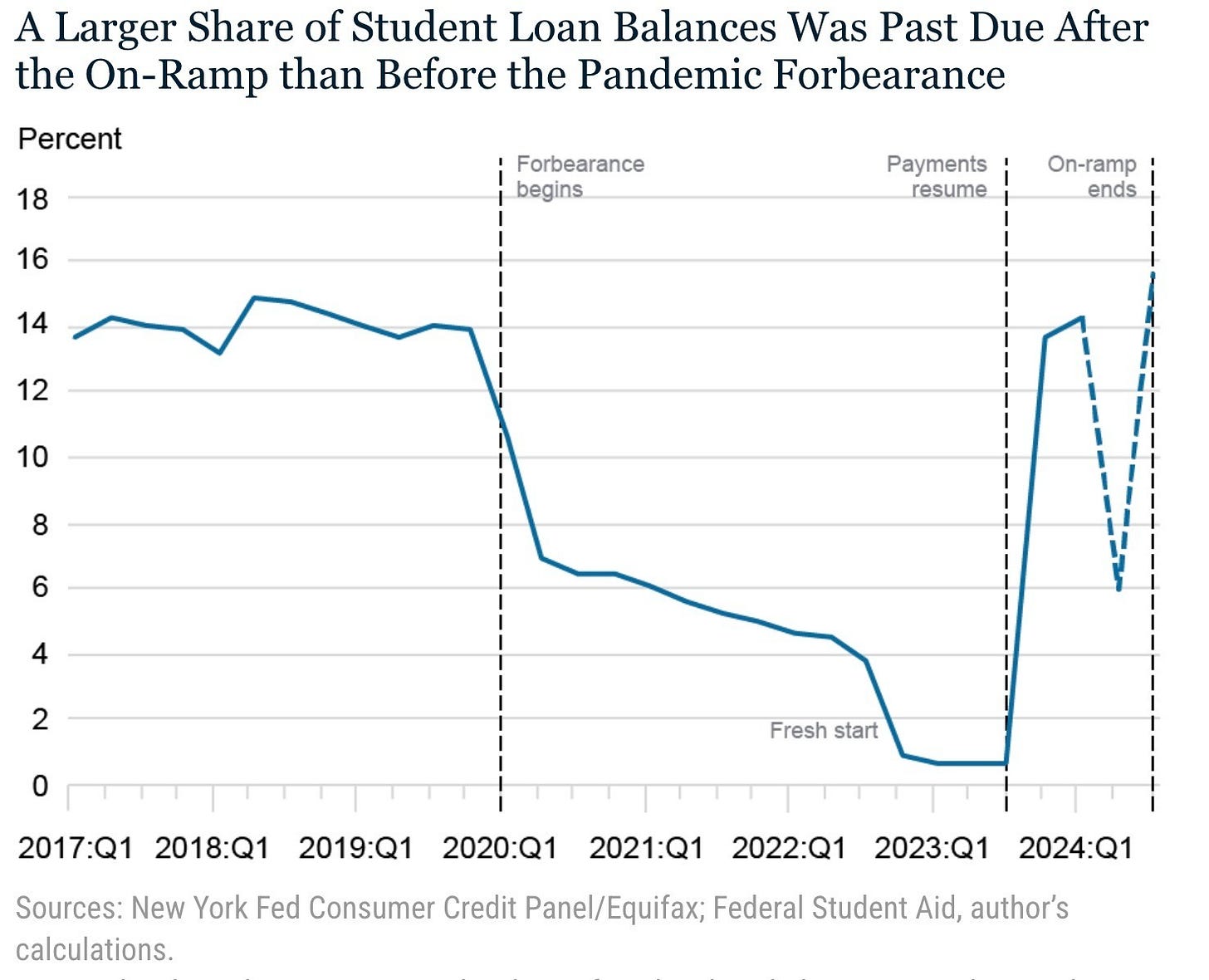

The resumption of student loan payments has made a bad problem far worse. In March 2020, at the start of the COVID pandemic, the first Trump Administration suspended student loan payments and set interest rates to 0%. This pause provided much-needed relief for tens of millions of student loan borrowers, giving them breathing room to buy essentials, finance a new car, build some savings, and weather the economic uncertainty of the pandemic. President Biden extended the pause, but when it ended in October 2023 after more than three years, over 28 million Americans were thrown back into a repayment system designed to fail them. Nearly 9 million borrowers – roughly 40% of borrowers who had bills due – missed their first payment after the pause ended, a clear sign that borrowers weren’t financially ready for what was coming.

To ease the transition back to repayment, federal officials implemented a one-year grace period that shielded borrowers from credit damage for missed payments. When this protection ended in October 2024, the collection floodgates opened, leading to the spike in delinquencies we’re now seeing on credit reports. On May 5, Secretary McMahon announced that the administration would resume debt collections from borrowers with defaulted student loans. Since then, the administration has temporarily stopped seizing Social Security payments from borrowers in default to pay back their debt. However, it is unclear how long they will keep this harmful practice on pause. In the meantime, forced collections through other means continue apace.

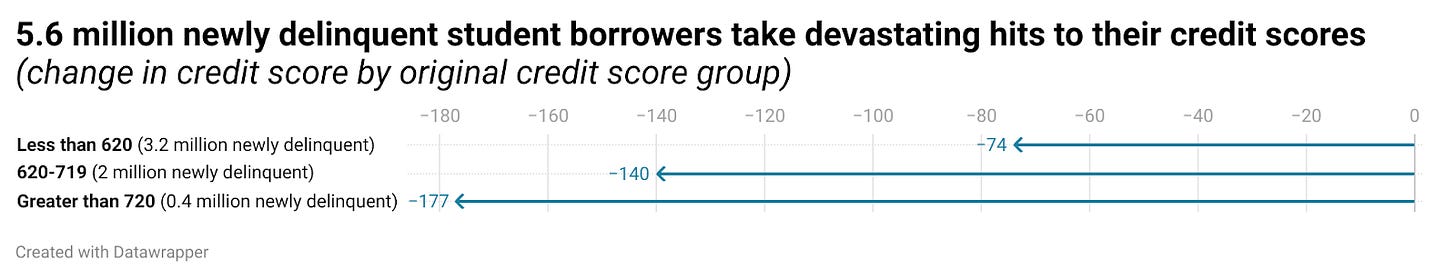

Collections will affect the 5.6 million Americans who, according to the Federal Reserve Bank of New York, were newly delinquent on their student loans during the first quarter of this year. Delinquencies skewed older in the same time period, as a staggering one in four borrowers over the age of 40 was delinquent. Those ages 40-60 hold more total debt than those under the age of 40, particularly mortgage debt. The resumption of payments is another ball they now have to juggle to make ends meet.

Falling into delinquency/default on student loans is extremely costly for families. 2.4 million of those newly delinquent borrowers have watched their credit scores plummet by more than 100 points, effectively locking them out of traditional credit markets and making it nearly impossible to secure new loans or credit cards when they need them most. In addition, life has gotten even tougher for more than 3 million newly delinquent student loan borrowers who entered this crisis with already damaged credit.

A damaged credit score is a financial scarlet letter that can follow consumers for years. It can mean borrowers paying thousands more in interest rates on car loans, if they can get approved at all. It can mean being rejected for mortgages, forcing people into expensive rental markets where they build no equity. It can mean paying security deposits for utilities, cell phone plans, and apartments that those with good credit get for free. Nearly half of all employers now run credit checks, meaning damaged credit can cost someone a job opportunity.

For young adults just starting their careers, damaged credit creates a vicious cycle: they need affordable credit to build financial stability, but they can’t access affordable credit because their credit scores are damaged. This forces them toward predatory payday lenders, rent-to-own schemes, and other high-cost financial products that further undermine their economic prospects.

This crisis did not emerge in a vacuum. The devastating impact of student loan payments can be traced to Trump and Republicans in Congress. In 2023, when Congressional Republicans held the economy hostage and threatened to default on our nation’s debt, they demanded a requirement to end the pause on student loan payments in the debt ceiling legislation. And it was Trump’s hand-picked judges and Republican attorneys general who blocked student loan cancellation policies aimed at easing the burden on struggling borrowers. When the Biden administration attempted to implement more generous repayment terms and provide relief to borrowers facing economic hardship, Republican extremists and Trump’s judges stood as a barrier to progress.

Now Trump’s economic agenda threatens to push millions more over a financial cliff. Trump’s “Big Beautiful bill” is an assault on struggling borrowers. The legislation eliminates virtually every existing student loan repayment plan that provides meaningful relief to borrowers, replacing them with far less generous alternatives. The cost is staggering: the typical family will be forced to pay over $400 more each month. Faced with higher monthly payments, it’s likely that millions more Americans will be at risk of defaulting on their student loans and a cascade of other defaults will likely follow.

While Trump and Republicans push policies that will spike monthly payments for struggling borrowers, they are simultaneously moving to destroy the Consumer Financial Protection Bureau, the agency that has protected students from predatory lenders and servicer failures that lead to missed payments. The CFPB’s work holding servicers accountable and helping borrowers resolve disputes has never been more important. But Trump’s CFPB has announced it will deprioritize protecting student borrowers, and it has dropped lawsuits against predatory servicers. Meanwhile, Senate Republicans are moving to eliminate the agency’s funding entirely.

The impact of imposing this much pain on millions of borrowers will be felt across our country. Rising delinquencies and higher loan repayments create headwinds for the U.S. economy. When millions of consumers are forced to allocate more of their income to debt servicing, they have less to spend on the goods and services that drive growth. According to economists at Morgan Stanley, resumed student loan payments are estimated to increase household loan payments by $1 billion to $3 billion monthly and reduce real GDP growth by up to 0.15 percentage points this year alone — money that won’t be spent on new sneakers and eating out. And if Trump’s “Big Beautiful bill” passes as written, the Student Borrower Protection Center estimates that more than $40 billion will be diverted from growing the economy in the first year alone. As people are squeezed by higher debt payments and increasing delinquencies, more of them will be pushed into the waiting arms of higher-cost predatory lenders, further constraining the money borrowers will have available to spend.

The Trump administration’s mishandling of student loan debts creates another threat for the broader economy.

But a crash is not yet inevitable. Congress is deliberating a budget and it is possible to choose policies that support borrowers instead of enriching shady student loan servicers. The administration could shift policies so that the Department of Education provides borrowers with genuine relief instead of political theater. It is not too late for our country to reaffirm our core values and recognize education as a public good that benefits all of us.