Lower Costs for Billionaires, Higher Costs for You

Why Donald Trump’s “Big, Beautiful Bill” is ugly for our economy

By Jon Donenberg, Banking Committee Democrats Staff Director

During his 2024 presidential campaign, Donald Trump repeatedly promised to lower costs “on day one.” He said that his focus on prices was one important reason why he won. But when he got into office Trump did the opposite. Right now, President Trump and Congressional Republicans are ramming through his “Big, Beautiful Bill” that will raise costs for Americans, balloon the deficit, and drag down our economy – all to give giant tax breaks to billionaires and billionaire corporations. A review of nonpartisan analyses of the “One Big Beautiful Bill Act” (OBBBA) show just how damaging this bill would be to families and the American economy.

I. Adds to the Deficit

According to the non-partisan Congressional Budget Office, the OBBBA would add $2.4 trillion to the national debt over the next decade—and a staggering $10.8 trillion by 2055. If temporary provisions become permanent, that number balloons to $18.7 trillion. Even under the most conservative assumptions, interest payments alone on the new debt could reach $5 trillion a year by the 2050s.

And it’s not just the CBO. Every credible independent analysis has concluded that the OBBBA will raise deficits even after accounting for growth effects that the Trump Administration claims will be large enough to offset the costs of this bill.1

II. Raises Costs for Lower- and Middle-Income Families

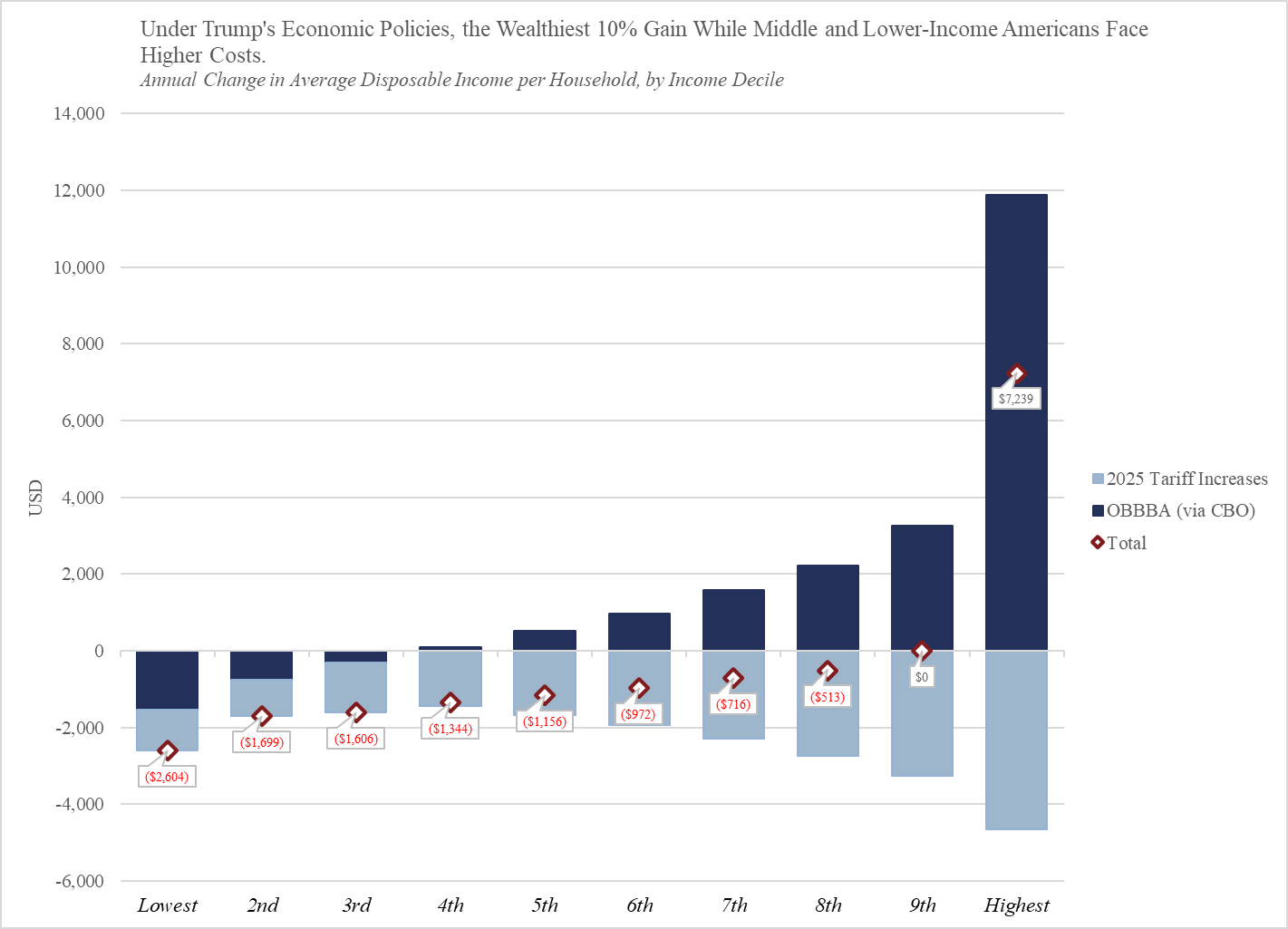

OBBBA’s true priorities become crystal clear when examining who pays and who profits. While the wealthiest Americans stand to gain from permanent tax breaks and estate tax exemptions, working families are left to foot the bill. The CBO’s analysis reveals that families in the lowest income bracket will lose $1,600 annually, largely from cuts to Medicaid and food assistance (SNAP).

Middle-class families fare little better, seeing any modest tax relief obliterated by service cuts and skyrocketing borrowing costs for everything from mortgages to car loans. Meanwhile, the top 10% of earners – those who need help least – will see their after-tax income surge by more than $12,000 per year. This isn’t tax policy; it’s a massive wealth transfer from struggling families to those already living in luxury.

Yesterday, during a hearing in the Senate Finance Committee, Secretary Bessent acknowledged CBO’s estimates that the OBBBA would increase the deficit by $2.4 trillion and justified its cost by asserting that it will be offset by tariff revenue. In a separate analysis, the CBO estimates that the tariffs will reduce the deficit by $2.5 trillion, but at the expense of American families. But with Trump’s red-light, green-light game of tariffs, it is unclear what if any impact his tariffs would have on the deficit.

The same CBO report estimates that the tariffs will increase inflation by an average of 0.4 percentage points in 2025, and again in 2026. According to the Yale Budget Lab, the tariffs that were implemented as of June 1 will cost the average household $2,500 per year in the short-run. The tariffs disproportionately affect lower income households. Combined with OBBBA’s regressive tax structure, Trump’s economic agenda represents a coordinated assault on working families to fund tax breaks for millionaires and billionaires.

The math is undeniable: Trump’s economic policies benefit only the wealthiest 10% of Americans while reducing income for everyone else – a stark betrayal of the working families who form the backbone of our economy.

III. Slows Growth

While Trump and Republicans in Congress claim these tax giveaways to the wealthy will fuel economic growth, there’s no evidence to support that view in the long term. Nonpartisan experts estimate that OBBA will drag on economic growth in the decades ahead, making our economy smaller than it would be if OBBA does become law. Why? Because OBBA blows up the national debt. By pushing deficits sky-high, this legislation risks raising interest rates across the board—making it more expensive for businesses to invest and hire, consumers to purchase homes, cars, and other necessities, and raising the risk of a broader economic slowdown.

While Trump and Republicans in Congress claim these tax giveaways to the wealthy will fuel economic growth, there’s no evidence to support that view in the long term. Nonpartisan experts estimate that OBBA will drag on economic growth in the decades ahead, making our economy smaller than it would be if OBBA does become law. Why? Because OBBA blows up the national debt. By pushing deficits sky-high, this legislation risks raising interest rates across the board—making it more expensive for businesses to invest and hire, consumers to purchase homes, cars, and other necessities, and raising the risk of a broader economic slowdown.