The Hidden Cost of Trump’s Budget

A note from our Staff Director on how rising Treasury rates means higher mortgage, car loan, and credit card costs for Americans.

With the House of Representatives voting to advance President Trump’s budget-busting tax bill, all eyes are on what’s happening in the bond markets – and in particular to Treasuries. We thought it might be helpful to explain what these markets are, what’s happening to them – and why Americans should care

What are the bond markets – and what’s happened to them this week?

Bond markets are where investors buy and sell debt securities, including U.S. Treasury bonds that finance government spending. This market can serve as an indicator of investor confidence in our nation’s economic health and influences borrowing costs across the economy – for government, businesses, and consumers.

Last Friday, on May 20th, Moody’s made waves as the final member of the “Big Three” credit rating agencies to downgrade the U.S. government’s credit rating. The move came as House Republicans were debating President Trump’s tax bill, which will cut taxes for the wealthy while slashing funding for Medicare, Medicaid, and other critical programs. Despite the deeply damaging cuts to our nation’s safety net that threaten to throw 15 million people off their health care, the net effect of the legislation will be to add an extraordinary amount to our national debt – an increase of $3.8 trillion over 10 years, according to the Congressional Budget Office. While many saw the timing of Moody’s downgrade as a warning to Congressional Republicans about their harmful, “big, beautiful bill,” the House ignored this warning and passed this legislation anyway.

The Moody’s analysis is consistent with the response of bond markets this week. 30-year Treasury yields – the interest rate that investors receive on their 30-year Treasury bonds – spiked above 5% to their highest level since 2023. As we’ve discussed in previous posts (first about Trump’s tariff chaos and later on how his policies are cornering the Fed), Treasuries are traditionally considered a global safe haven. When their yields rise dramatically, it signals heightened long-term risk and a growing concern about America’s economic stability.

Is this week’s episode just a market correction?

People often attribute fluctuations in the bond market to so-called “bond vigilantes” – the idea that large institutional investors coordinate to sell bonds as a protest against fiscally irresponsible policies. Whether you buy this theory or, instead, believe that fluctuations are caused by individual investors acting independently, bond market volatility usually reflects temporary corrections as markets digest new information, rather than a warning sign of a looming crisis.

But while there has been some discussion of vigilantism related to recent yield spikes, that discussion ignores a larger, more troubling picture. Since Donald Trump’s return to office, Treasury yields have climbed steadily, accompanied by persistent volatility, a weakening dollar, and surging prices on U.S. credit default swaps. This combination of indicators suggests that Trump’s chaotic approach to governance and the resulting policy uncertainty are durably undermining confidence in America’s financial system, creating a perfect storm of warning lights that extend beyond typical market corrections.

I. 30-year Treasury Yields

On Wednesday, the 30-year Treasury yield reached 5.14%, the highest level since October 2023, and as CNBC noted, “is within reach of 5.18% — a level last seen in 2007, the year before the Global Financial Crisis.”

II. U.S. Dollar

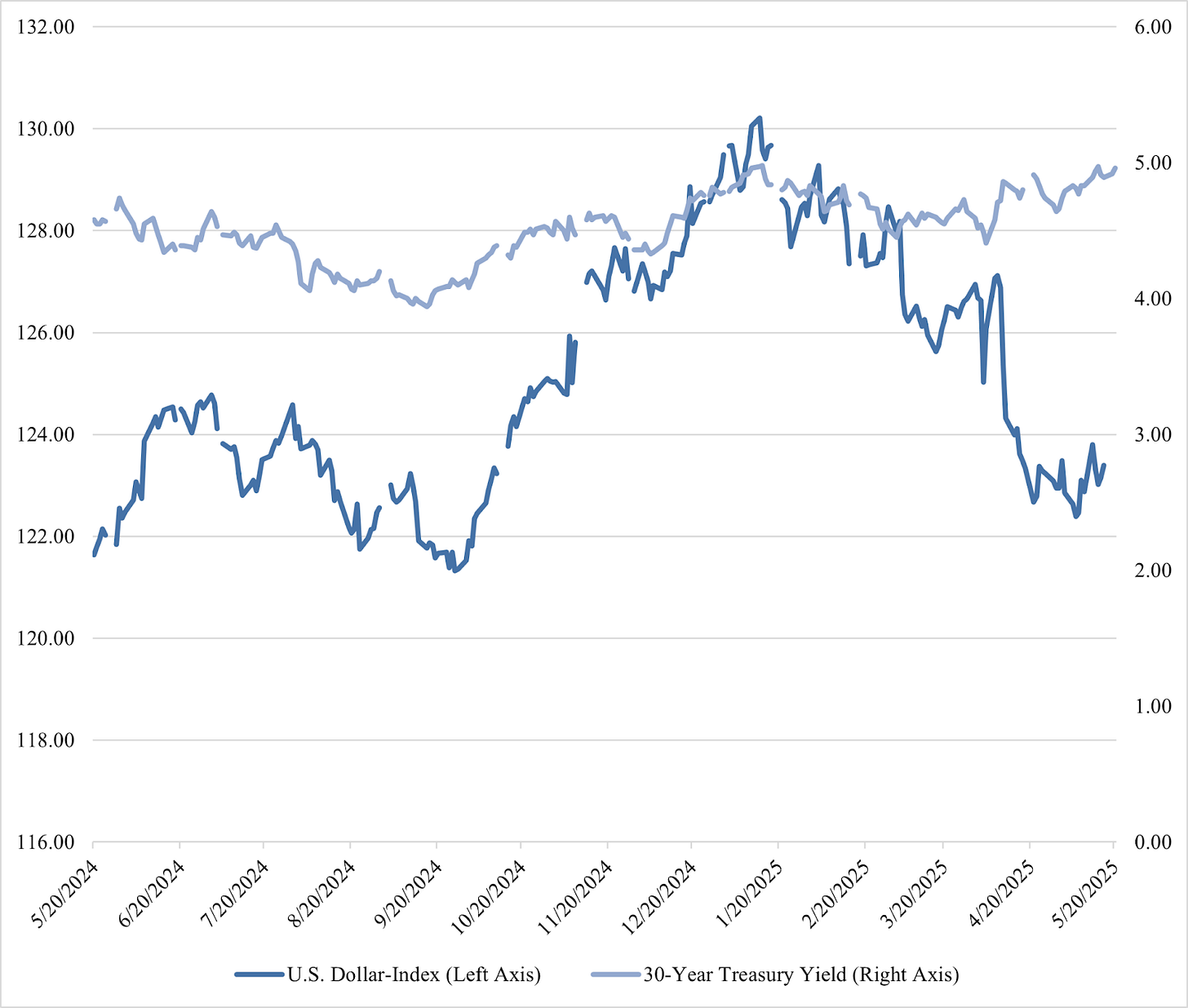

Long-term yields and the U.S. dollar typically move in the same direction. After all, higher yields mean higher returns – which should attract foreign capital, strengthening the dollar. Under Trump, however, these two indicators have been diverging. When yields rise as the dollar weakens it signals deeper concerns about America's fiscal health and suggests investors are losing confidence in the soundness of the U.S. financial system.

As one Bloomberg article noted, April “was only the third time in more than 50 years that the dollar declined more than 2.5% while the 10-year Treasury yield rose by at least 25 basis points.” The previous instances – in 1985 and in May 2009 – both preceded sustained dollar weakness, suggesting that the current pattern may signal the beginning of a longer-term shift in global confidence toward U.S. economic leadership.

III. U.S. Credit Default Swaps

U.S. credit default swaps are essentially insurance contracts that pay out if the U.S. government defaults on its debt. A rise in the price of this type of asset indicates growing concern about America’s creditworthiness and ability to repay our debt obligations. Since January, the price to insure against a US default has risen to levels comparable to those last seen during recent debt ceiling stand-offs – meaning that in his first few months, Donald Trump has created a sustained and increasing sense of economic instability even in the absence of a potentially acute crisis like breaching the debt limit.

United States 5 Years CDS

Why does any of this matter for American consumers?

These financial market dynamics might seem abstract and mostly relevant to Wall Street traders. They do, however, have real consequences for consumers through higher long-term interest rates. Because treasury rates serve as a benchmark for other borrowing in the economy, a rise in the rates that the government pays to borrow ends up driving higher costs for other lending products, such as consumer mortgages (which are currently ticking up along with yields), car loans, and credit cards. More expensive borrowing for US companies could also limit the ability of businesses to invest in hiring, putting greater pressure on the labor market. So while Trump and Republicans slash government funding to partially pay for budget-busting tax cuts for the wealthy, consumers will be forced to pay more for credit in an already challenging economic environment.