Trump Tariff Chaos in Six Charts

A note from our Staff Director on how Trump’s massive tariffs are crashing our economy

Policy debates in Washington and on Wall Street often play out at a technical level that can seem inaccessible to folks who don’t spend all day reading regulations or poring over economic data. And even those who are steeped in that information can often miss the forest for the trees. Data can provide some insights into new risks and opportunities faced by workers and families, but the unemployment rate doesn't mean much to a person who’s out of work and a quarterly GDP projection doesn’t tell you much about whether it will be easier or harder this year to put food on the table for your family.

Over my time working on these issues, I have found it most useful to think about the economy from the perspective of a working family – sitting around the kitchen table, trying to figure out how to pay the bills every month (and, hopefully, how to set aside a bit of savings for retirement). Ensuring broad-based prosperity for all of our families should be our primary goal. And I can think of few times in my career when this perspective was more important than right now.

Since this is my first post, I’m going to dive right into the topic everyone is talking about – the Trump tariffs and their impact on our economy. As I write today, we are teetering on the edge of economic collapse. In this post, we’ll walk you through some of the best data we’ve seen in recent weeks that demonstrate how, exactly, Trump’s approach to tariffs is threatening to take down the American economy.

Let's dive in.

We’ll start with the Federal Reserve. Congress directed the Fed to balance three sometimes contradictory goals – stable prices (i.e., keeping inflation reasonably low and predictable); maximum employment (i.e., as many jobs as possible without triggering inflation); and moderate long-term interest rates (i.e., keeping borrowing costs over time reasonable, so that the cost of borrowing to invest in things like new or expanded businesses remains manageable and predictable). The Fed does this by using a variety of technical tools to try to speed up or cool down the economy to keep these goals in balance.

Select Fed presidents and governors convene eight times annually for the Federal Open Market Committee (FOMC) meetings, where they deliberate and determine the strategic deployment of such monetary policy tools. At last month’s meeting, committee participants provided their forecasts for key economic indicators. These individual projections are consolidated into the FOMC’s Summary of Economic Projections, which, among other things, presents median values for:

Real Gross Domestic Product (GDP) growth (Q4 2024 to Q4 2025);

Unemployment rate (projected for Q4 2025);

Personal Consumption Expenditures (PCE) inflation (annual average);

Core PCE inflation excluding food and energy (annual average); and

Federal funds rate (projected for end of 2025)

In essence, this summary represents the collective outlook of Fed presidents and governors on where they expect the economy to stand by year-end, based on analyses of internal data and external economic conditions. And what this group presented last month is very, very scary.

In just three months, the FOMC’s projected change in real GDP – in other words, upcoming growth in the national economy – dropped by 0.4 percentage points. Even worse, the FOMC simultaneously projected that inflation and unemployment would be higher. The combination of these factors raises fears of “stagflation” – a situation with high unemployment and high inflation but very little economic growth. We haven’t seen that since the 1970s, and it’s very difficult for the Fed to address.

Only one major thing changed between December 2024 and March 2025 – the inauguration of President Trump, and the execution of his new policies on the economy, including a chaotic and extreme approach to tariffs.

That’s the Fed’s conclusion as well. Chair Powell said himself that a “good part” of the worsening inflation outlook was thanks to Trump’s tariffs. And if this weren’t concerning enough, his comments about these projections came on March 19, near the beginning of Trump’s tariff rollercoaster ride. Since then, we’ve had Trump’s “Liberation Day”– when he announced so-called “reciprocal” tariffs on every country in the world – and the Administration's 90-day pause (which still left in place indiscriminate, across-the-board tariffs, including a 145% tariff on China and 10% tariffs on everybody else on the planet).

So, what does this all mean for the economy? In short, the outlook for our economy – growth, unemployment, and inflation – appears significantly less favorable than the already worrisome estimates we saw in the Fed’s March projections. Indeed, last week, Chair Powell revised his assessment, acknowledging that he underestimated the policy changes and their impact, stating that “the level of the tariff increases announced so far is significantly larger than anticipated. The same is likely true of the economic effects, including higher inflation and slower growth.” And while Chair Powell previously characterized potential tariff-induced inflation as likely transitory, in light of these subsequent decisions by the Trump Administration, he has cautioned that it could prove more persistent.

It’s clear these massive across-the-board tariff policies are a drag on our economy. But almost as concerning is the uncertainty underlying these policy choices. While the policy direction has remained the same, the Administration is wildly shifting the details of its tariff policy on a day-by-day (and sometimes hour-by-hour) basis. Experts in government and the private sector have made clear that the chaos means businesses will pull back their investments in the future because of the “uncertainty tax” that comes from not being able to plan ahead in a wildly unpredictable economic environment. And the chaotic swings in policy, which have been mirrored by chaotic swings in the stock market, present any number of corruption challenges – for example, making it easier for large corporations and wealthy, connected individuals with the ear of the president to obtain sweetheart exemptions, and raising the opportunities for market manipulation and insider trading.

It’s hard to sift through all the news on markets and the economy, so here are some graphs that help illustrate the extent to which Trump’s tariff policies are harming families, workers, and businesses.

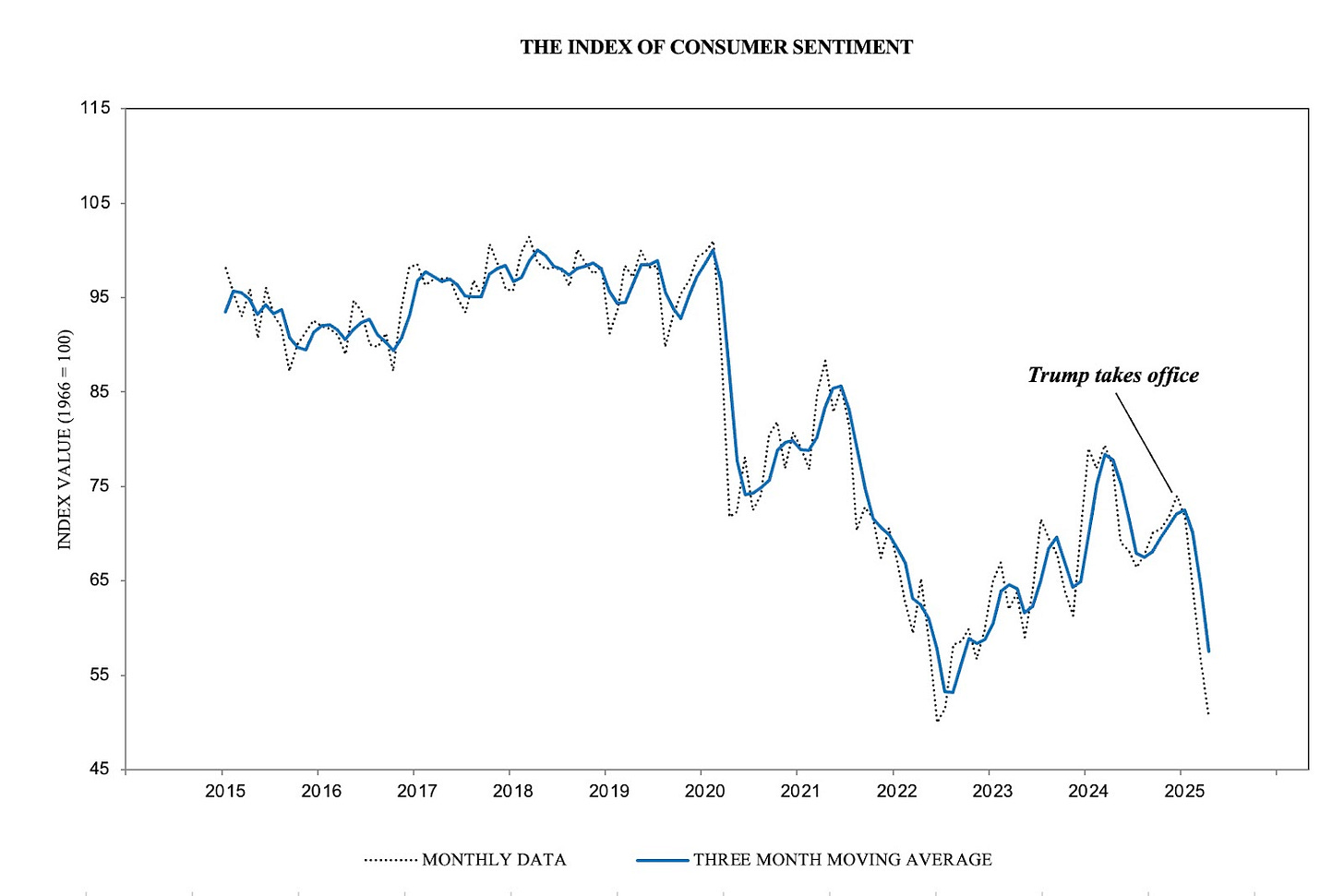

I. Consumer sentiment is plunging

Source: University of Michigan, Survey of Consumers

Consumer sentiment has declined sharply since President Trump took office in January. Understandably, Americans are worried about Trump’s tariffs raising costs, triggering layoffs, and causing more chaos and confusion.

Why should we care if people think the economy is souring? Because this indicator can help us understand what consumers are actually going to do in the coming weeks and months – and in our economy, that’s most of the ballgame. Consumer spending accounts for nearly 70% of the U.S. GDP. When consumers pull back on discretionary purchases due to uncertainty and higher prices, it creates a ripple effect through the economy. Businesses typically respond by scaling back production, delaying investments, and potentially reducing their workforce, all of which further contribute to economic contraction. So as this number plunges toward pandemic-era lows, it’s a flashing red light on what might be in store in the coming months.

II. Consumer costs will increase

"nec" = "Not elsewhere classified"

Source: The Budget Lab analysis

The Trump Administration’s tariffs apply to everything, everywhere, with some (ever shifting) exceptions. When governments impose tariffs on foreign goods, importers must pay these taxes to bring products into the country. In addition, when they are applied to intermediate outputs in a supply chain, tariffs impose an additional production cost that must be absorbed somewhere in the supply chain.

In many instances, it appears likely that these added costs will make products in the store more expensive for consumers. Theoretically, businesses can respond by negotiating new prices with exporters or absorbing the cost themselves. In practice, though, they typically pass costs on to consumers through higher retail prices.1

In addition, the constantly shifting policy details around how exactly the tariffs are applied, the confusing and unpredictable application of exemptions, and the Administration’s loud insistence on applying tariffs to almost everything, all create huge incentives for opportunistic companies to take advantage of the environment to hike prices regardless of the necessity to do so. As Chair Powell pointed out last month, “washing machines were tariffed in the … last round of tariffs, and prices went up, but prices also went up … on dryers, which were not tariffed … so the manufacturers … just kind of followed the crowd and raised [prices on non-tariff goods].”

Estimates of the scope of price increases for consumers are, of course, going to be very speculative. But to take one recent analysis by The Budget Lab at Yale, Trump's tariffs are projected to cost the average U.S. household $4,900 annually. The dollar amount remains constant regardless of household earnings – after all, this is a consumption tax – which means it falls the hardest on those with less income. The Budget Lab estimates that households in the second-lowest income decile2 will experience a substantial 5.1 percentage point reduction in disposable income, while those in the highest income decile will face a 2.1 percentage point decrease. Trump’s tariffs will create more financial strain on working and middle-class families, who must allocate more of their budgets to cover these increased costs.

In addition to raising costs on everyday items, Trump's tariffs will drive up the cost of constructing new housing at a time when housing affordability is already a critical issue. The increased costs on essential building materials will add thousands of dollars to the average new home's price tag, which could affect both owners and renters. The uncertainty surrounding these tariffs has already contributed to an 11.4% decline in housing starts in March, further exacerbating America's housing shortage of about 5 million units.

III. Financial conditions are worsening

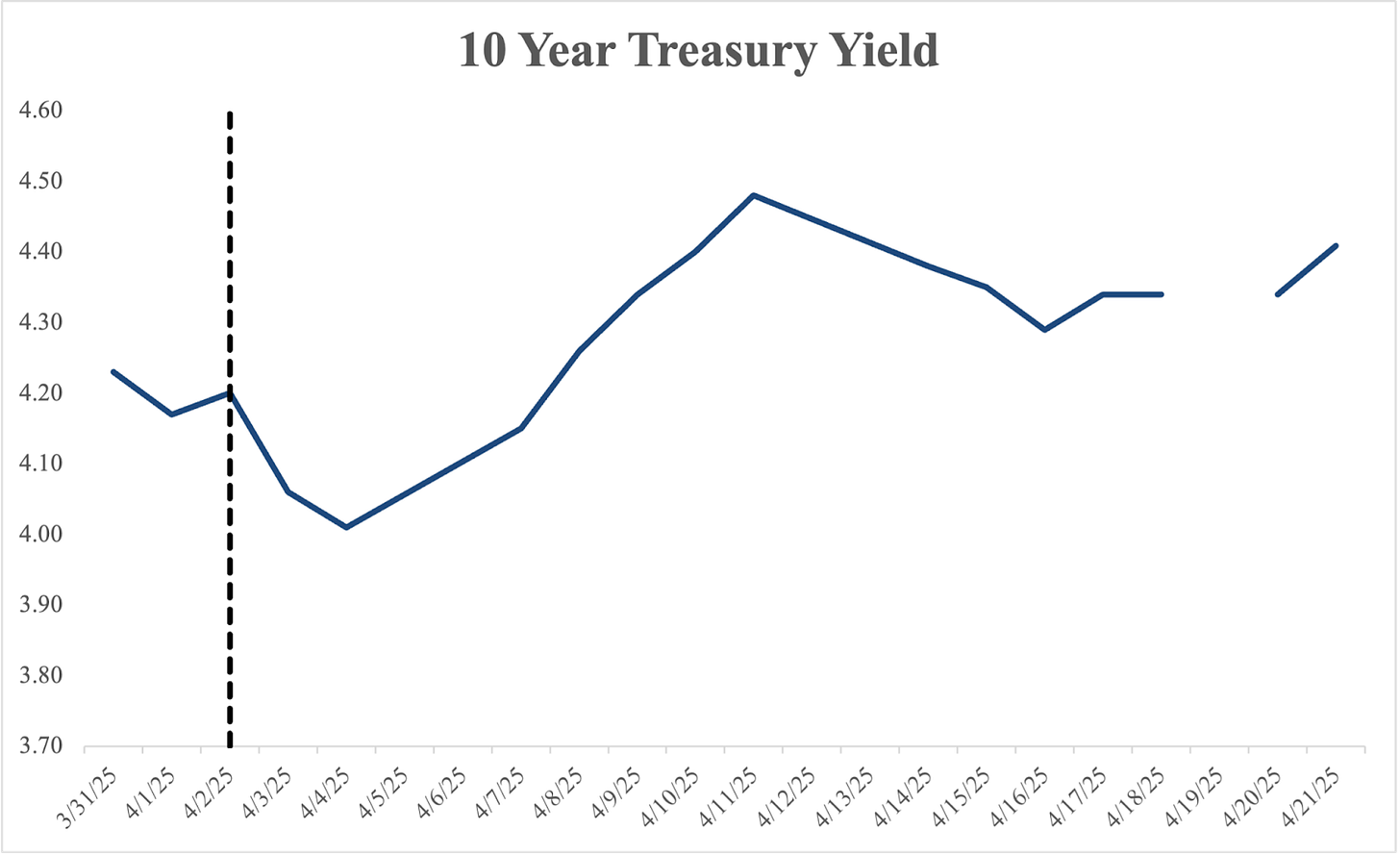

Source: Board of Governors of the Federal Reserve System (US) via FRED; CNBC

Trump’s “Liberation Day” announcement crashed equity markets and created explosions of volatility across an array of financial markets – many of which are still reeling today. But if you want to understand where our economy is headed over the medium term, perhaps the most important of these stories is what’s happening in the U.S. bond market. Above is a graph of the 10-year treasury yield since April 1.

Treasury “yields” are the rate of interest that investors receive on their Treasury securities. As a matter of simple supply and demand, when the price of treasuries goes down, yields go up. In times of economic crisis, you would expect treasury yields to go down, as U.S. Treasuries have long been a global safe haven for investors. (Somewhat infamously, despite the financial crisis of 2008 originating in the United States, during that period, yields went down – meaning that investors worldwide still believed that the U.S. government was the world’s safest investment – even when America was the cause of the meltdown!)

Yields did in fact drop initially in the two days following Trump's tariff announcement, likely due to recession fears and investors moving to the safety of Treasury bonds. On April 4, however, yields jumped dramatically from under 4% to 4.5%, while the 30-year yield exceeded 5%. They have remained significantly elevated despite the President’s adjustment in tariff policy, which Trump conceded was made in response to exactly this crisis in the bond markets. What does this mean in practical terms? It means that bond values are plummeting because investors are second-guessing whether the U.S. government and economy are still a safe bet. As noted in this Brookings analysis, this signal of investor doubt corresponds directly with the alarming collapse of the U.S. dollar index that, yesterday, plummeted to its lowest level in three years.That’s a scary thought, but it’s not surprising – after all, even the 2008 meltdown, which originated here, was not caused on purpose by American policy choices. This crisis, however, is.

Beyond being a canary in the coal mine for the long-term preeminence of the American economy, these movements have practical impacts on families. Banks and other lenders use Treasury rates as a benchmark. That means that if Treasury rates go up, so too will mortgage, auto, credit card, and other loan rates. The sell-off also exposed certain risks in our financial system that have been building over the past several years, as hedge funds play an increasingly large role in the Treasury market (they hold more than 27% of Treasuries). They have increased the market’s fragility, as they finance their Treasury holdings with massive amounts of debt. This leverage leaves them vulnerable to swings in the market like we just saw, causing them to off-load Treasuries rapidly, pushing down the price and further increasing yields.

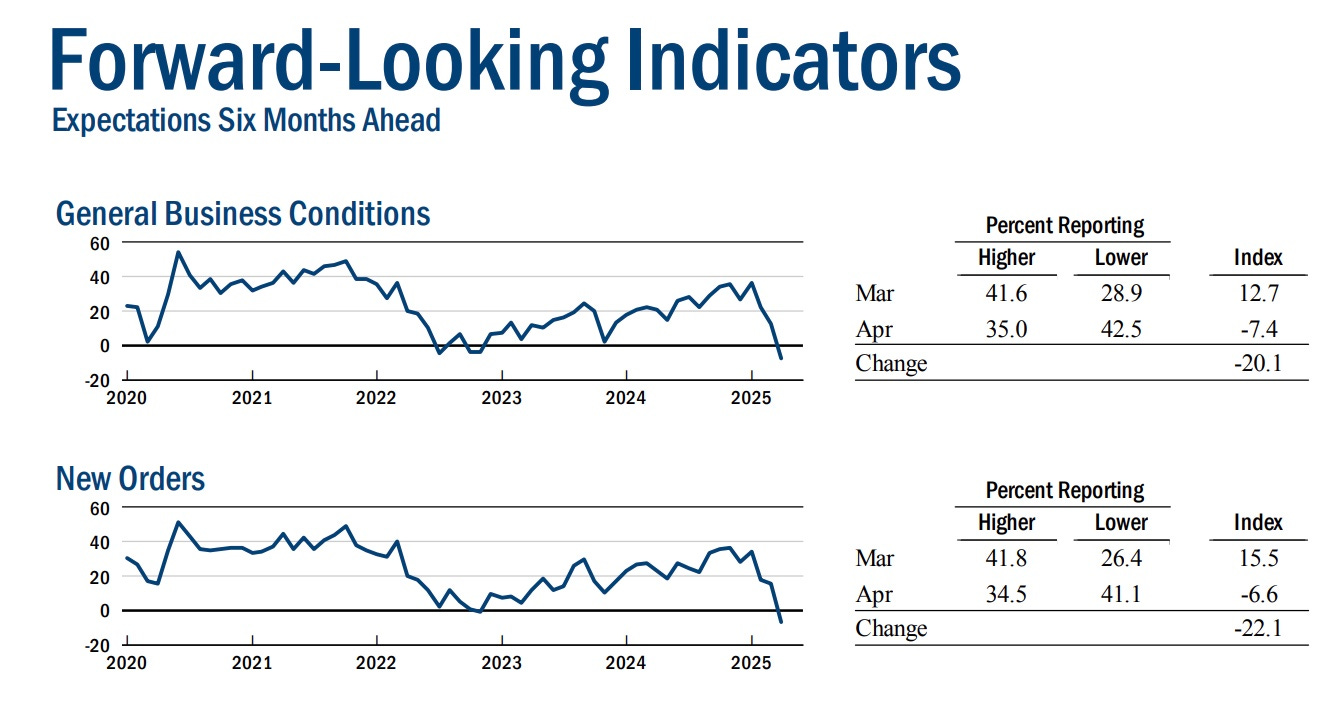

IV. Businesses are growing pessimistic

Source: New York Fed Empire State Manufacturing Survey

The Federal Reserve Bank of New York is one of the 12 regional reserve banks that makes up the Federal Reserve system. In April, the New York Fed published its April Manufacturing Survey, a widely respected report that collects data on business activity and outlook from manufacturers across New York state. April survey responses were collected between April 2 and April 9, capturing business expectations after Trump’s “Liberation Day” announcement but before he announced a 90-day pause on some tariffs. The results show that – according to businesses themselves – Trump’s tariffs and the subsequent uncertainty are bad for business. As summarized in the survey, “firms expect conditions to worsen in the months ahead, a level of pessimism that has only occurred a handful of times in the history of the survey.” The Philadelphia Fed also released its monthly manufacturing survey last week, which showed a significant drop in manufacturing activity – “the fourth-largest monthly decline in history, only trailing drop-offs seen in 2020 and 2008.”

The survey shows that manufacturing activity in New York State declined for a second consecutive month, with the general business conditions index remaining negative, despite an improvement from March. Most concerning is that firms have turned notably pessimistic about future conditions, with the forward-looking index plummeting, after falling significantly over the three months to a level representing the second-lowest reading in the survey's 20+ year history (see graph above). New orders, a leading indicator of future production and economic activity, have continued to decline. And when businesses receive fewer orders, they typically respond by reducing production, inventory, and potentially employment. The combination of contracting activity, declining new orders, and the dramatic shift to pessimism among manufacturers suggests significant headwinds for the manufacturing sector and potentially for the wider economy if these trends persist.

V. Layoffs are on the horizon, and hiring is frozen

Source: CEO Confidence Index, April 2025, Chief Executive Group. ChiefExecutive.net

One of the bright spots of our economic recovery post-COVID has been a robust labor market. Put simply, coming into 2025, lots of Americans had jobs, the unemployment rate was low, and wage growth has been stronger than at any other point in a generation. Trump’s tariffs are throwing the durability of this achievement into serious question. As consumers face higher prices and grow more cautious, demand will inevitably decline. When this happens, businesses will reduce production and subsequently need fewer workers.

Unfortunately, this isn’t just a theory – businesses themselves are putting layoffs on the table. While employment at the moment remains relatively robust,, many companies are already forecasting decreased hiring in the coming year. Several surveys, including CNBC’s survey and the CEO Confidence Index shown above, indicate that CEOs increasingly expect layoffs down the line. We are seeing early examples of this impact with major employers like Volvo, which has already announced layoffs directly attributed to the new tariffs. And economists are predicting that these tariffs could raise unemployment significantly from its current levels – to 4.7% by the year-end. Although the overall labor market is relatively stable at the moment, it has noticeably weakened in recent months, with declining job openings and slowing wage growth exposing vulnerabilities. Trump’s tariffs will be bad for workers who already face a challenging environment – and his policies are doing nothing to support them.

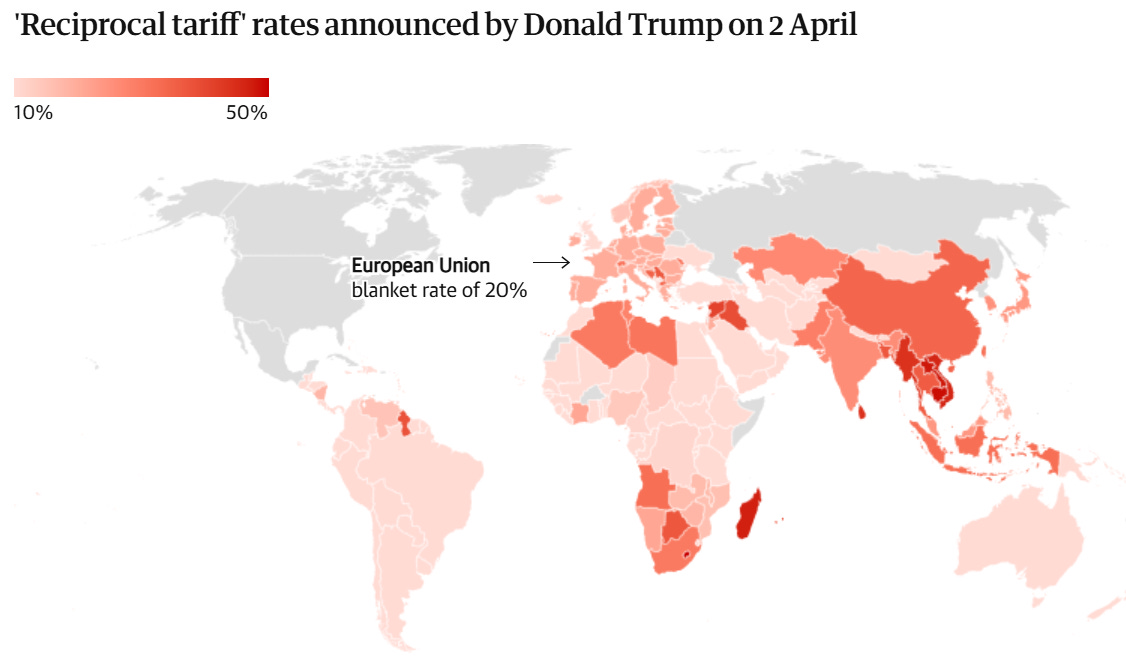

VI. Global outlook is deteriorating

Source: Guardian graphic, using information from The White House.

Note: excludes tariffs previously announced for Canada and Mexico and universal 10% tariff applied to remaining countries not covered by ‘reciprocal’ rates. Some small island territories have been excluded from the map.

Finally, while our principal focus is the American economy, the global implications of Trump’s tariff agenda is worth considering as well – in part because of how challenges abroad will ultimately hurt us here at home. The President’s tariff brinkmanship is having global reverberations as trade partners retaliate and consider rebalancing trade relationships away from the United States.

The spotlight is currently on China, which has had the fiercest response to Trump’s tariffs – levying a 125 percent tariff on U.S. imports and turning to an expansive toolkit of economic measures to retaliate. Last week, for example Beijing ordered the Chinese airliners to stop accepting deliveries of Boeing jets, potentially locking the struggling U.S. aviation company – America’s biggest exporter – out of one of the world’s largest passenger airliner markets. The country also suspended export of certain rare earths and magnets, a move that could have ripple effects through global supply chains for automobiles, electronics, and aircraft. These moves are almost certainly calibrated to impose pain on the U.S. economy, but also aimed at undercutting Trump’s goal of reshoring manufacturing. For instance, last week Beijing quietly announced that it would exempt U.S. chipmakers that outsource manufacturing from the United States from retaliatory tariffs – a clear sign that Beijing is not just engaged in a tit-for-tat, but thinking strategically about how it can undercut the U.S. over the long term.

Many of us in both parties believe that it is important for American trade policy to shift the United States and our allies away from our dependence on China for key strategic supply chains, and to counter obvious efforts by China for many years to undercut important industries here at home. The Trump Administration could have pursued a smart and targeted set of trade policies to help move us closer to these goals. Instead, after antagonizing the rest of the world - including our closest allies whom we have spent years working to persuade to shift away from China – Administration officials now find themselves scrambling to convince other countries to stand with the United States against China. As one expert put it, the Trump Administration “took about every conceivable action to sabotage this strategy” before articulating it. The Administration bullied its partners instead of engaging them. And we are still threatening them and demanding concessions. At the same time, the Administration is asking these same partners to give up on Chinese trade and foreign investment in return for benefits that our partners can’t trust will actually materialize over time, given how often the President changes his positions.

President Trump lashed out about President Xi’s tour of Southeast Asia, which is transparently intended to build support against the United States. But Trump’s tariff threats made Xi’s job easier. Take a look at the heat map published by The Guardian that shows which countries saw the highest “reciprocal” tariff rates that Trump threatened. Now ask yourself, if you are the leader of one of those countries, whether you should trust that America won’t revert to the punishing and nonsensical trade policies it imposed on your nation just three weeks ago.

Beyond brewing U.S.-China antagonism, is it worth taking a step back and asking what the deteriorating international environment means for the U.S. economy. When goods stop moving, there are consequences throughout the supply chain. Increasingly, data points like ocean freight bookings are pointing towards a supply side shock reminiscent of the COVID-19 pandemic. Then, like now, global trade disruptions crippled supply chains and caused chaos for manufacturers and consumers. This means production lines are likely to come to halt and consumers will struggle to get basic goods. Of course, the major difference is the last major supply chock was caused by a deadly pandemic – this one is caused by one man.

Today marks 92 days since President Trump was sworn in, and his policies have already begun causing significant economic damage across multiple sectors, with worse likely outcomes ahead. From plunging consumer sentiment to rising costs for households, from financial market volatility to manufacturing pessimism, the economic indicators consistently point to an economy on the brink of a recession. The tariffs not only threaten to raise costs by thousands of dollars for average American families but have also ignited international retaliation. Nobel economists warned that Trump’s proposals during the 2024 campaign would harm the economy if actually put into practice – and we are already seeing some of the devastating impact those policies will have on American businesses, workers, and families. Unless there's a significant policy reversal, Americans can expect a continued economic meltdown – with extreme market volatility, higher prices, more layoffs, and slower economic growth throughout 2025 – all preventable consequences of the Trump tariff strategy.

About the Author

Jon Donenberg serves as the Staff Director for the Democrats on the Senate Committee on Banking, Housing, and Urban Affairs. He previously served as Deputy Director of the National Economic Counsel at the White House, where he worked to advance economic policy change on behalf of working families across a variety of areas – from financial regulation, private sector competition, and tech infrastructure and accountability, to consumer financial protection and consumer debt.

Side note: This is why, in normal times, tariffs can incentivize domestic manufacturing, because when applied in a targeted and predictable way, higher prices on foreign goods encourage businesses to source their products and inputs from the United States. But Trump is actually disincentivizing manufacturing right now by allowing exemptions for big businesses to import finished goods while slapping tariffs on almost everything else, including intermediate goods that businesses need to manufacture in the United States.. It’s no surprise that we’ve already seen overall U.S. manufacturing start to contract and headlines like “Tariff Woes Depress U.S. Manufacturing, Erode Labor Demand” and “U.S. Manufacturing Slips into Contraction as Costs Surge, Pressured by Trump Tariffs.”

There is not enough data available to estimate the costs to households in the lowest income decile.